Introduction: The Hidden Value of Accurate Share Registers

Accurate share registers are the foundation of informed decision-making for any company. They determine how ownership is tracked, how shares are transferred, and how cap tables evolve over time. Yet, despite their critical importance, many businesses unknowingly rely on outdated systems like snapshot-based registers, which capture data at fixed points in time. While these snapshots can offer a momentary glimpse into the state of ownership, they fall short in providing the full picture, especially when companies need to answer complex questions about their history, compliance, and decision-making processes.

The limitations of snapshot-based systems become more apparent as companies grow and face more complex challenges—whether during audits, fundraising, or mergers and acquisitions (M&A). That’s why a more dynamic, ledger-based approach offers a powerful solution. By continuously logging every change and event as they occur, a ledger-based system offers complete accuracy and trustworthiness.

What’s the Difference? Snapshot-Based vs. Ledger-Based Approaches

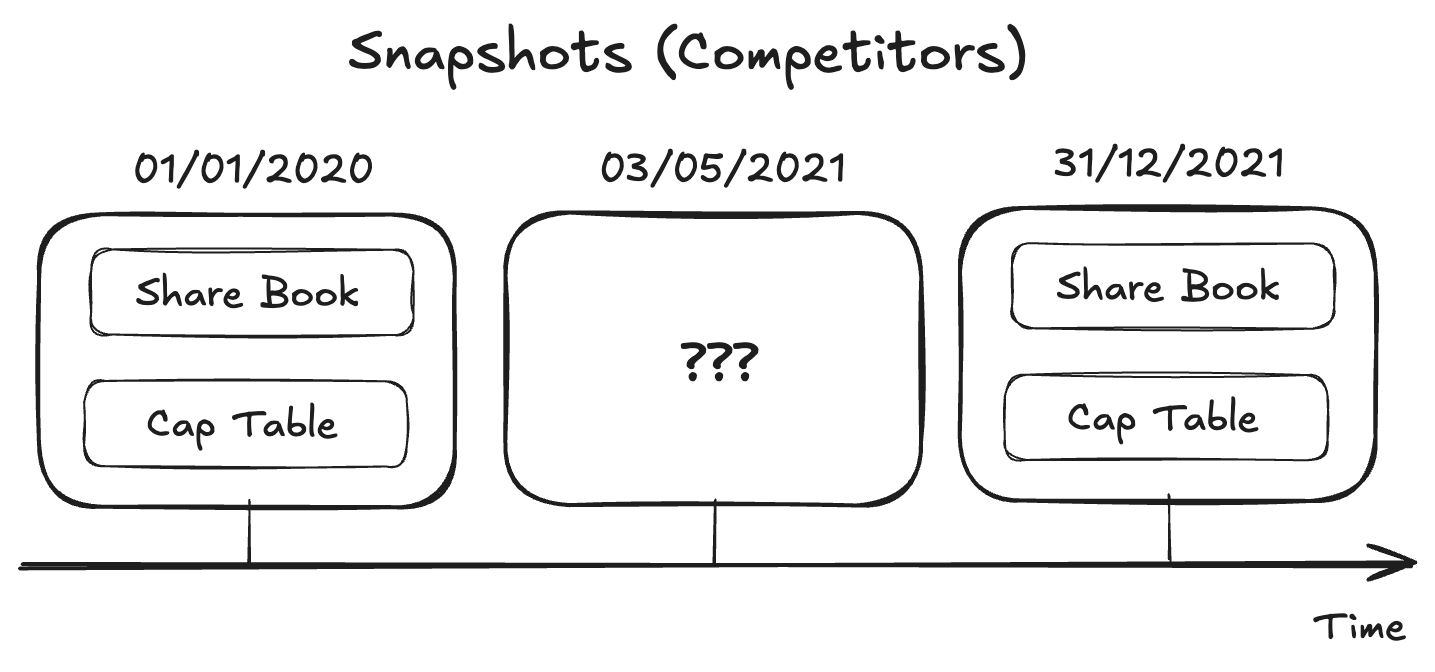

When we talk about digital share registers, two methods typically come up: snapshot-based and ledger-based approaches. The fundamental difference between the two is how they record ownership changes over time.

Snapshot-Based Approach:

A snapshot-based system captures the state of the share register at specific moments. Imagine taking a photograph of your share register every quarter or every time a major event occurs. This “snapshot” shows you the state of things at that moment—who owns what, how many shares each shareholder has, etc. However, it doesn’t show you how or when those changes happened. Any activity between snapshots is invisible unless it’s manually reconstructed.

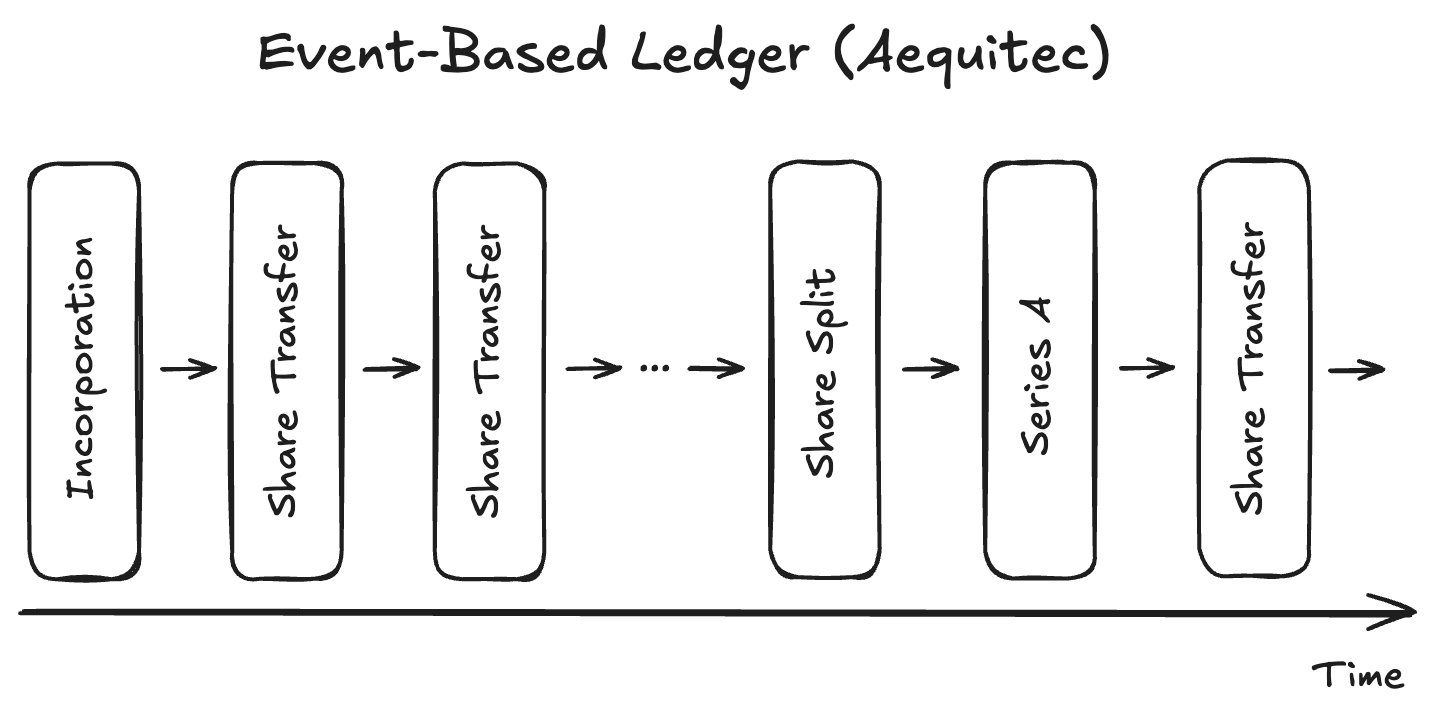

Ledger-Based Approach:

A ledger-based approach, by contrast, records every change as an event in a continuous timeline. Think of it like a digital ledger that logs each transaction—each issuance, transfer, or share split—as it happens. Instead of fixed points in time, a ledger provides a comprehensive, chronological history of all share-related events. You can see not only the current state but also how you got there, with no gaps in the data.

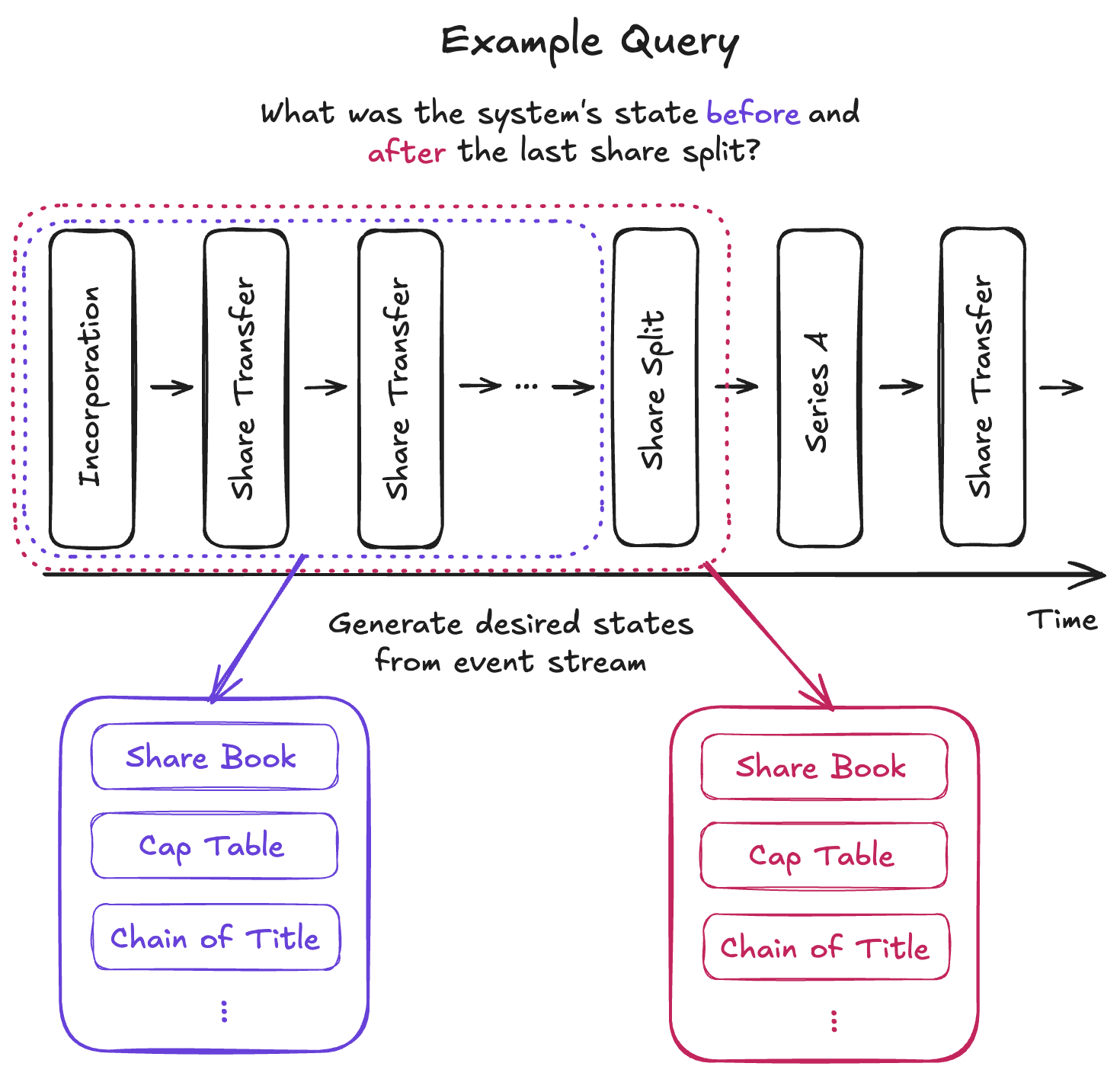

Questions a Ledger-Based System Can Answer (But a Snapshot Can’t)

The true value of a ledger-based approach shines when you need to dive deeper into the history and evolution of your share register. Here are a few key questions a ledger-based system can answer with ease, where snapshot-based systems would fall short:

1. “Who held shares on a specific date, and what events led to their ownership?”

Ledger (✔️): You can not only see who held shares at any given time, but also view the full sequence of events that led to that ownership. Every transfer, share class mutation, or issuance is logged and traceable, providing a full audit trail.

Snapshot (❌): While a snapshot can show you who owned shares on a specific date, it cannot explain how ownership changed over time or show the intermediate steps that led to that point.

2. “How many shares were transferred between shareholders over the past year, and how did those transactions affect the ownership structure?”

Ledger (✔️): A ledger system tracks every transaction, making it easy to identify how many shares were transferred, between whom, and how this affected the overall cap table. You can see the impact of every transaction without needing to manually compile or verify data.

Snapshot (❌): Snapshots provide isolated moments in time. Any transactions between these moments are not captured, which means a lot of manual effort is needed to reconstruct a full picture.

3. “What was the state of the cap table before a particular funding round, and how did the issuance of new shares change it?”

Ledger (✔️): You can view the precise state of your cap table at any moment before or after a specific event—like a funding round. It allows you to track share issuance and its impact on the overall ownership structure with perfect accuracy.

Snapshot (❌): Snapshots often only capture the final state after the event, leaving you without the historical context needed to understand the changes that occurred.

Real-World Benefits for Your Business

While the technical differences between snapshot-based and ledger-based systems are clear, the real-world advantages for businesses are even more significant. Let’s explore how a ledger-based approach enhances key areas of your operations.

1. Transparency and Trust

A ledger-based system provides unparalleled transparency while ensuring that data visibility is controlled based on roles and permissions. Every transaction is logged, but only authorized individuals—such as shareholders, company executives, and auditors—can access the information relevant to them. This ensures that sensitive data is protected, while still allowing stakeholders to view the information they need with confidence. Everyone has access to accurate data, knowing that nothing has been missed or altered, all within the boundaries of their assigned permissions.

Real-World Impact: Imagine going into an audit and having the ability to instantly pull up the entire history of ownership changes. No manual reconciliation is needed because the ledger shows exactly who did what, when, and why. This level of trust reduces friction and potential disputes, while also fostering better relationships with stakeholders.

2. Improved Compliance and Auditability

Compliance is a major concern for businesses, especially as regulations around ownership and reporting become more stringent. A ledger-based system ensures a clear, immutable audit trail that meets regulatory standards. Auditors can quickly trace every share transaction and verify that all records are accurate and complete.

Real-World Impact: Companies that use ledger-based systems often find that audits take less time, and compliance risks are significantly reduced. You no longer need to scramble to piece together historical records from scattered snapshots, saving both time and resources.

3. Decision-Making Insight

One of the most overlooked advantages of a ledger-based system is its ability to provide decision-makers with real-time, actionable insights. Whether you’re preparing for a funding round or evaluating the impact of issuing new shares, a ledger-based system gives you accurate, up-to-date information that allows for informed decisions.

Real-World Impact: By having a clear view of ownership data and cap table changes, leadership teams can make faster and more confident decisions during strategic events like fundraising, M&A, or even in everyday operations. You can instantly see how decisions will affect ownership, share dilution, or voting power—without the delays caused by manual data gathering.

| Feature/Capability | Snapshot-Based Register (Competitors) | Ledger-Based Register (Aequitec) |

|---|---|---|

| Real-Time Updates | ❌ No | ✔️ Yes |

| Complete Historical Record & Audit Trail | ❌ No | ✔️ Yes |

| Accurate at Certain Specific Dates | ✔️ Yes | ✔️ Yes |

| Continuous Tracking Between Events | ❌ No | ✔️ Yes |

| Immutable Record (Tamper-Proof) | ❌ No | ✔️ Yes |

| Transparency & Compliance | ❌ No | ✔️ Yes |

| Efficient for Audits, Legal, and Regulatory Needs | ❌ No | ✔️ Yes |

| Streamlined Cap Table Management | ❌ No | ✔️ Yes |

How a Ledger-Based Approach Enables Smarter Business Operations

Beyond the day-to-day benefits of improved accuracy and transparency, a ledger-based approach fundamentally changes how companies operate, allowing for smoother scaling and more robust business processes.

Historical Integrity for Future Proofing

As companies grow, maintaining accurate records of ownership becomes crucial—not just for today, but for future transactions and compliance. A ledger-based approach ensures that historical records are always available and accurate, providing confidence during key moments like IPOs or acquisitions.

Operational Efficiency

By automating the process of recording and managing share transactions, a ledger-based system significantly reduces the manual workload for legal, finance, and operations teams. The reduced administrative burden frees up time for these teams to focus on higher-value tasks, such as strategic planning or managing investor relations.

Conclusion: A Smarter Approach to Share Registers

The difference between snapshot-based and ledger-based approaches is more than just technical—it’s about providing a system that grows with your business, reduces risk, and empowers better decisions. By embracing Aequitec’s ledger-based share register, companies can unlock new levels of transparency, efficiency, and trust that benefit both today’s operations and future growth.